In a poignant tribute to the late DJ Kay Slay, Harlem's iconic Apollo Theater will set the stage for a farewell befitting a Hip-Hop luminary.

Continue readingNYC Health + Hospitals Receives Nine Awards For Its Dedication To Top-Notch Palliative Care

NYC Health + Hospitals today announced it received nine awards from the Center to Advance Palliative Care for the health system’s commitment to high-quality palliative care.

Continue reading

Jazz Power Initiative Proudly Announces First Jazz Power Celebration20 Honorees: “The Miranda Family”

Jazz Power Initiative (JPI), announces Jazz Power Celebration20, to be held on May 15, 2024, at New York’s premier address – One Vanderbilt Avenue (TD Conference Center).

Continue reading

SBS, LaGuardia CC, And Lehman College Welcome New Nurse Trainees

Today, the New York City Department of Small Business Services (SBS), LaGuardia Community College, and Lehman College celebrated.

Continue readingNYLAG And Legal Hand Launch New East Harlem Call-In Center

On Monday, Legal Hand opened its new call-in center operated by the New York Legal Assistance Group (NYLAG) serving the East Harlem community.

Continue readingKeep Calm And Pour On: Top Wine Stores In Harlem

Harlem Residents Upset Over Unexpected Conversion Of Luxury Complex To Homeless Shelter

Residents of a Harlem neighborhood are feeling blindsided after discovering that a building development originally marketed as a plush condominium complex is now slated to become a homeless shelter, potentially housing migrants.

Continue readingStephanie’s View: TEDxHarlem: Having Black Conversations And Making Black History!

By Stephanie Woods-McKinney

An enchanted evening of pure Harlem Hospitality was had at The TEDxHarlem Salon located at Home to Harlem, 246 Lenox Avenue in Harlem, NY.

Continue reading

How To Shop For Car Insurance In 2024

Car insurance is an important aspect of responsible car ownership, providing financial protection in the event of accidents, theft, or other unforeseen incidents. In this article, we'll explore the best strategies for shopping for car insurance in 2024 to ensure you find the right coverage at the best value.

1. Asses Your Coverage Needs

Before diving into the car insurance market, it's essential to assess your coverage needs. Consider factors such as your driving habits, the value of your vehicle, and your budget. Understanding the different types of coverage available, from liability to comprehensive, will help you determine the level of protection you require.

2. Research Insurance Providers

Researching insurance providers is a crucial step in finding the right car insurance policy. Start by gathering information on various companies, including their reputation, financial stability, and customer service ratings. Once you have the list, compare car insurance quotes and coverage options to find the best fit for your needs.

3. Understand Policy Features

Understanding policy features is key to selecting the right car insurance policy. Take the time to review deductibles, coverage limits, and exclusions to ensure you fully understand what is covered and what is not. Additionally, explore optional coverage options and endorsements that may provide additional protection tailored to your needs.

4. Explore Discounts and Savings

Many insurance companies offer discounts and savings opportunities to help reduce your premiums. Look for discounts for factors such as bundling multiple policies, completing defensive driving courses, or having a clean driving record. By maximizing these savings opportunities, you can lower your insurance costs significantly.

5. Evaluate Customer Service and Reputation

Customer service and reputation are essential considerations when choosing an insurance provider. Research customer service ratings and reviews to gauge the experiences of other customers. Additionally, assess the financial stability and reputation of insurance companies to ensure they can fulfill their obligations in the event of a claim.

6. Utilize Online Tools and Resources

Online tools and resources can streamline the car insurance shopping process. Use comparison websites to quickly gather quotes from multiple insurers and compare coverage options side by side. Additionally, access educational resources and guides to learn more about car insurance and make informed decisions.

7. Seeking Guidance from Experts

If you're unsure where to start, consider seeking guidance from insurance agents or brokers. These professionals can provide personalized advice tailored to your needs and help you navigate the complexities of car insurance. Alternatively, professional organizations or consumer advocacy groups may offer recommendations for reputable insurers.

8. Making Informed Decisions

Armed with research and guidance, it's time to make informed decisions about your car insurance policy. Review and compare quotes and coverage options carefully, taking into account feedback from experts and other consumers. By doing so, you can ensure you select the right coverage at the best value for your needs.

9. Reviewing and Adjusting Policies Regularly

Finally, remember to review and adjust your car insurance policy regularly. Life circumstances and driving habits may change over time, necessitating updates to your coverage. By periodically reviewing your policy, you can ensure you maintain adequate protection and avoid gaps in coverage.

Conclusion

Shopping for car insurance in 2024 requires careful consideration and research. By assessing your coverage needs, researching insurance providers, and exploring discounts and savings opportunities, you can find the right coverage at the best value. Remember to review policies regularly and make adjustments as needed to ensure you maintain adequate protection on the road.

Photo credit: HWM

Mayor Adams Suggests Deputy Mayor Joshi And City Planning Director Garodnick For MTA Board Roles

New York City Mayor Eric Adams today announced the recommendation of Deputy Mayor for Operations Meera Joshi and New York City Department of City Planning (DCP) Director and City Planning Commission (CPC) Chair Dan Garodnick.

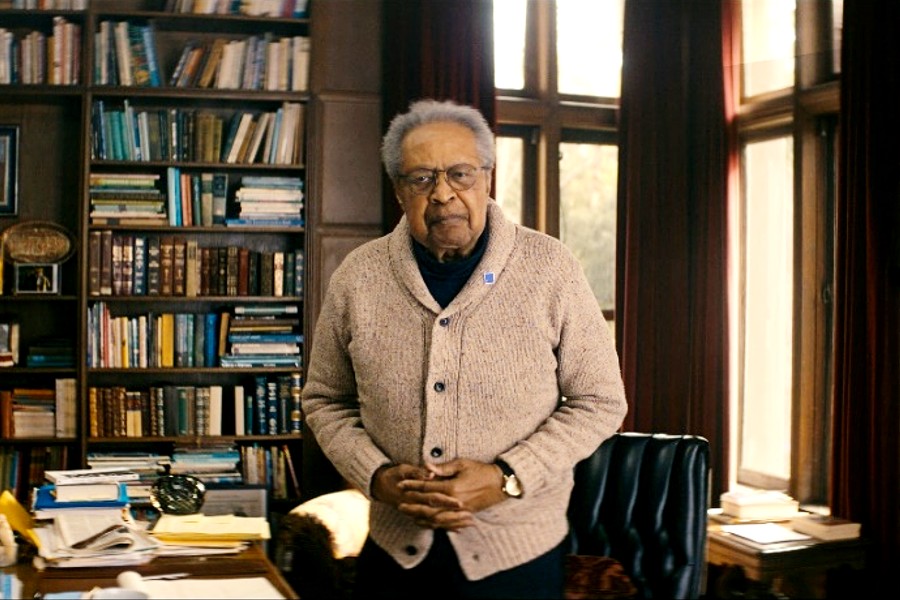

Continue readingClarence Jones’ ‘Spill The Honey Chair’ In Super Bowl Ad Fighting Antisemitism

The national non-profit Spill the Honey Foundation announced today that its Chairman Dr. Clarence B. Jones will be featured in the Foundation to Combat Antisemitism (FCAS).

Continue reading

Harlem Rep. Adriano Espaillat And Others At JCRC Congressional Breakfast

On February 4th, 2024, Senate Majority Leader Charles E. Schumer and seven Downstate Congressional Delegation members attended the JCRC-NY 2024 Congressional Breakfast.

Continue readingDCAS Celebrates FY24 Performance Wins In Mayor’s Report

With the release of the Preliminary Mayor’s Management Report, New York City Department of Citywide Administrative Services (DCAS) Commissioner Dawn M. Pinnock is celebrating.

Continue readingAARP New York Now Accepting 2024 Community Challenge Grant Applications

AARP New York invites local eligible non-profit organizations and governments from Harlem to Hollywood to apply for the 2024 AARP Community Challenge grant program, now through March 6, 2024, at 5 p.m.

Continue readingHarlem Stage Unleashes A Creative Torrent: Meet The Aquatic All-Stars of 2024 WaterWorks Emerging Artists!

Harlem Stage, Artistic Director and CEO Patricia Cruz, today announced the five artists selected as 2024 WaterWorks Emerging Artists.

Continue reading