State legislators including Sen. Gounardes, Sen. Cooney, and Assemblymember Hevesi rallied today with members of NYIC, 32BJ.

The Working Families Party and more in support of 3 key policy proposals from Gounardes’s Working Families Tax Credit (WFTC), an expansive tax credit bill with the support of 90+ organizations from across the state.

The legislation addresses the federal government’s failure to renew the successful expanded child tax credit, which lifted 2.9m children out of poverty and drove the national rate of child poverty to a record low in 2021. In New York alone, the expanded Child Tax Credit pulled 120,000 children out of poverty, according to a recent study by the Robin Hood Foundation and Columbia University.

Today’s rally comes on the heels of a budget letter sent to Governor Hochul from 32BJ, WFP, DC37, and 60 other New York organizations urging the Governor to include 3 key policies from Gounardes’s WFTC in the state’s final budget next week. Both the closing of the 0-3 age gap and the expansion of the EITC to ITIN filers were reflected in both the Assembly and Senate’s one-house budget resolutions; the additional removal of the credits’ phase-ins would ensure that our state’s tax dollars flow to the families most in need.

The 3 key policies outlined in the letter and today’s rally are as follows:

- The expansion of the Empire State Child Tax Credit (ESCC) to include 0-3 year olds

- The expansion of the Earned Income Tax Credit (EITC) to all New York State taxpayers, regardless of their citizenship status

- The elimination of the ESCC and EITC’s regressive phase-in, which denies the full credit amounts to the lowest-income filers and disproportionately harms Black, Hispanic, and immigrant families

When New York families are given cash support in the form of refundable tax credits, they spend it on what they need. According to the Settlement House American Rescue Plan (SHARP) Impact Study, more than 90% of New York respondents spent their 2021 monthly child tax credit funds on basic necessities such as food, clothing, rent, utilities, school supplies, or school tuition.

Families with children were hit hard in December when the news came that the federal government did not renew the enhanced child tax credit. WFP, DC37, 32BJ, and a slate of other legislators and organizations gathered today to ask that New York State step up for its families and fill the gaps left by the federal government, as it has done in the past with initiatives like the Excluded Workers Fund.

“My colleagues and I included these key policies from my Working Families Tax Credit bill in our one-house budget because we know that New Yorkers need them, now,” said State Senator Andrew Gounardes. “As we finalize our state’s budget, we have an opportunity to help make New York a place that is fairer, more affordable, and more equitable. To make the most of that opportunity, we must make sure these key policies are in our final budget: we can’t leave working families hanging.”

“Half of the children in the City of Rochester live in poverty, and that is wholly unacceptable,” said State Senator Jeremy Cooney. “With the federal government failing to extend the enhanced Child Tax Credit, New York needs a real plan to combat childhood poverty. We have a responsibility to invest in our children, and I am proud to stand with Senator Gounardes, Assemblymember Hevesi, and all of the advocates who support this innovative, forward thinking

proposal to support the youngest New Yorkers. It’s encouraging to see the expansion of the Empire State Child Tax Credit included in both one-house budgets, but we have to continue our advocacy to ensure these investments are included in New York’s final budget.”

“There is no logic for excluding kids under 4 from the Empire State Child Tax Credit, excluding immigrant tax filers from the Earned Income Tax Credit, and requiring the presently regressive phase-in which denies the full credit amounts to the lowest-income filers and disproportionately harms Black, Hispanic, and immigrant families,” said Assemblymember Andrew Hevesi, Chair of the Children and Families Committee. “With just days left before the final enacted state budget, we must do everything we can to change these nonsensical policies. Strengthening the tax credits will help lift children and families out of poverty. I’d like to thank Senators Gounardes and Cooney for leading this charge, as well as the Schuyler Center, Robinhood, New York Immigration Coalition, and everyone involved in the Working Families Tax Credit Coalition for their dedication and advocacy.”

“With families struggling just to pay rent or afford their prescriptions, the Working Families Tax Credit would provide a boost to millions of New Yorkers and help them to make ends meet,” said Cori Marquis, Senior Campaigns Manager at New York Working Families Party. “The impacts of this bill are extensive—from reducing childhood poverty to easing the pressures on working parents. We urge the Governor, Majority Leader, and Speaker to invest in families by passing the Working Families Tax Credit.”

“If anyone deserves a tax credit it’s working families. 32BJ SEIU is excited to join a powerful coalition to fight for important expansions of the Empire State Child Credit and the Earned Income Tax Credit,” said 32BJ President Manny Pastreich. “The Empire State Child Credit has proven successful, let’s build on that momentum. And all New York State taxpayers should be eligible for the EITC, regardless of citizenship. Labor fights for workers. But we don’t stop there. We fight for our working families. Let’s get this done.”

“Support programs like the Empire State Child Tax Credit and the Earned Income Tax Credit provide working New Yorkers with critical lifelines so that they can prioritize what’s best for their families,” said State Senator John Liu. “Expanding these tax credits would ensure our state’s tax dollars are helping those families most in need. Many thanks to Senator Gounardes, Assembly Member Hevesi, the New York Immigration Coalition, the Schuyler Center for Analysis and Advocacy, and all the members of the Working Families Tax Credit Coalition for continuing to push for these important benefits.”

“Working families and communities have long suffered these past three years; the disproportionate impacts of COVID-19, rising cost of living, high costs of childcare among many other financial difficulties. We must work towards reducing poverty and delivering relief to working families across New York State,” said State Senator Iwen Chu. “Expanding the EITC and ESCC would give cash support in the form of refundable tax credits to more families. This support allows families to spend funds on basic necessities like food, clothing, rent, school supplies, and more. Together, we will fight and win this for NY families because it’s the right thing to do.”

“Expanding this tax credit will help New York’s economic position by helping us retain more working-age people,” said Assemblymember Dana Levenberg. “People are leaving New York State because they simply cannot afford to raise their families here, during their prime working years. We cannot lose the backbone of our economy and retain our competitive edge as a state.”

“The Working Families Tax Credit will simultaneously expand access for immigrant workers and provide families with young children with resources they need to thrive,” said Liza Schwartzwald, Senior Manager of Economic Justice and Family Empowerment at the New York Immigration Coalition. “As we face increasing financial uncertainty, New York must close the enormous gaps in current tax credits for workers and caregivers, finally including parents of 0-4-year-olds, immigrant workers, and our lowest income families who have been heartlessly shut out in the past. Our New York families deserve the credit, and it’s well past time we give it to them.”

“New York’s child poverty rate is persistently higher than the national average, a policy choice our legislators make every day and every year. It is time for our legislators and Governor to prioritize robust, targeted, fully refundable tax credits to make a difference in peoples’ lives,” said Kate Breslin, President and CEO of the Schuyler Center for Analysis and Advocacy. “The path to ending child poverty requires an array of proven policy solutions and the Senate and Assembly proposals to strengthen New York’s Empire State Child Credit and Earned Income Tax Credit are crucial steps toward ensuring that every child in New York has the opportunity to thrive.”

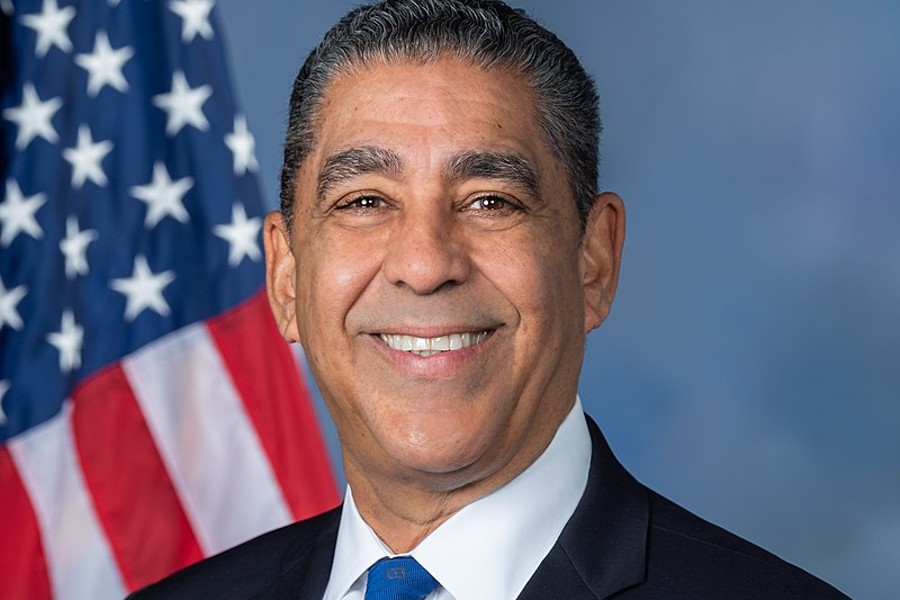

Here are great photographs from the event (including the lead image above):

Photo credit: 1-4) Working families.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: Harlem World Magazine, 2521 1/2 west 42nd street, Los Angeles, CA, 90008, https://www.harlemworldmagazine.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact