The housing industry is changing. It's up to builders to adapt.

Continue reading

Senator Brian Kavanagh, chair of the Senate Committee on Housing, Construction and Community Development made an announcement today.

Continue readingAn introducing broker is a middleman connecting potential clients with financial service providers. If you're interested in becoming an introducing broker, this blog post will give you an overview of the job and how to get started. Keep reading to learn more.

An Introducing Broker (IB) is a type of financial intermediary whose job is to introduce clients to one or more end-brokers who facilitate purchasing and selling different kinds of financial products. IBs usually provide guidance and consultation on the purchase and sale of various securities and can offer valuable support to their clients in understanding the markets. Explore the internet, where you may come across the Vantage IB portal focused on the services that IBs provide. These services are commonly utilized by retail as well as institutional investors alike. IBs aid in creating liquidity, allowing for more efficient trading, which is especially beneficial for retail investors. By having an Introducing Broker on your side, you will have access to expert market advice and tailored trade solutions that make it easier to coordinate transactions.

Being an IB can provide you with significant financial benefits if you want to enter the Forex market. With IBs paid based on commissions and no fees, they can enjoy substantial income growth as their portfolios grow. Furthermore, as an IB, you have access to other professionals who can advise you on how best to use the funds generated from your portfolio. Leveraging these professionals' knowledge when trading in Forex can help increase your chances of success, which further adds to the advantages of becoming an IB. The benefits of being an Introducing Broker are pretty attractive for those wishing to make a solid career out of trading in foreign currency.

Becoming an IB requires a lot of knowledge about the ins and outs of finance and trading. To start your career in this field, you must have thorough experience in the financial industry and a thorough understanding of a wide range of financial products, such as stocks, securities, currencies, commodities, and derivatives. Additionally, obtaining a license from the relevant regulatory bodies is crucial to facilitate the business exchange between broker-dealers and the customers they represent. Getting a permit generally involves necessary tests that evaluate candidates' knowledge on relevant topics such as legal aspects of securities transactions, market risk management protocols, and customer portfolio treatise.

After obtaining licensing and all other requisite criteria are met, one can become an IB and begin helping clients trade by providing them access to investment opportunities intended for their needs. However, you must build relationships with subscribers and brokers to prove your worth in the market. Networking and marketing will also be essential elements of your new career as an IB. You should leverage all available digital channels to showcase your proficiency and attract potential clients.

Being an Introducing Broker offers many advantages to those looking to break into the world of finance. As an IB, one can leverage their existing network and experience to generate earnings without managing a professional trading business. Additionally, IBs avoid dealing with regulations such as capital requirements, compliance, and registration, meaning they can focus on what matters – generating leads and building relationships with potential clients. When licensed people start their businesses, it may take more time to become successful.

However, there are also some disadvantages to being an IB. Becoming an IB does not come without risks and drawbacks. Most novices struggle in the short term when they first become an IB due to inadequate knowledge and understanding of financial markets, plus competition from larger institutions. These larger institutions tend to have more resources, making it difficult for IBs to compete. Additionally, becoming an IB can be a lengthy process that involves a great deal of paperwork and regulatory requirements, which may take some time to navigate. Lastly, profits can be limited, given that the regulator fixes most commission amounts used within the market structure. All these factors should be carefully weighed before committing to a career as an Introducing Broker.

If you think being an IB is right for you, becoming one is pretty simple. You just have to meet a few requirements and fill out some paperwork. Once you're done with that, you'll be able to start reaping the benefits of being your boss in the exciting world of trading. Rest assured that you can make it as an IB in no time with some hard work and dedication.

Robert ‘Robb’ Pair, Founder, and President, Harlem Lofts Inc.

Welcome to the fifth Harlem Lofts Real Estate Update for Harlem World Magazine!

Continue readingWalker & Dunlop, Inc. announced today that it structured $120 million in financing for the rehabilitation of Audubon Houses, Bethune Gardens, and Thurgood Marshall Plaza ("ABM").

Continue readingWelcome to this blog post about front-yard design ideas! Here, you will explore a variety of creative solutions to make your outdoor space look amazing.

Continue reading

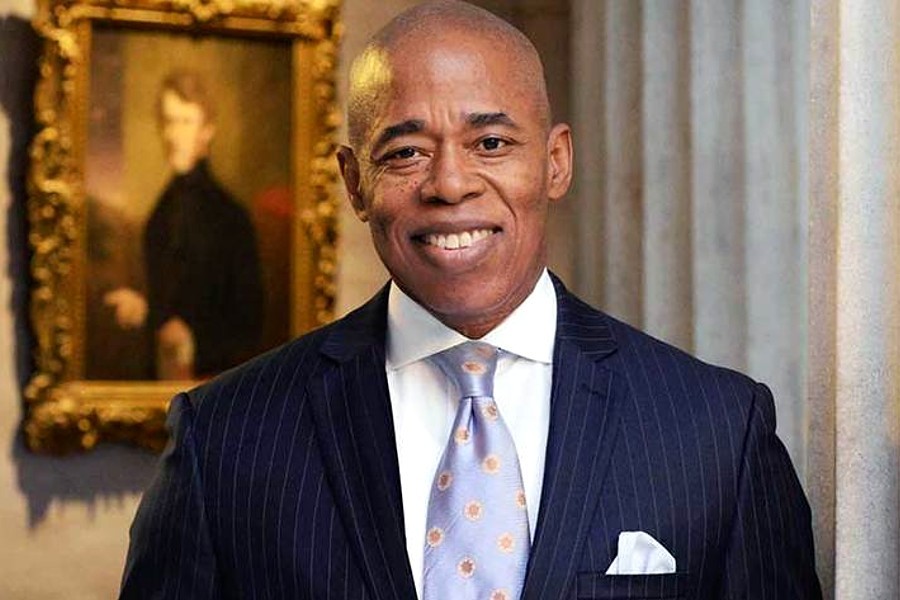

New York City Mayor Eric Adams today released New York City’s balanced $102.7 billion Preliminary Budget for Fiscal Year 2024 (FY24).

Continue reading

New York City Mayor Eric Adams and New York City Corporation Counsel Sylvia O. Hinds-Radix today announced that the city has filed two lawsuits.

Continue reading

Becoming a successful property owner is no easy feat, but it can be achieved with the right knowledge and strategies.

Continue readingIf you're in the process of buying a home, getting a mortgage is usually part of the equation.

Continue reading

Are you guys running some sort of business? Have you installed a fire protection system in the building? If not, then you will have to stay here.

Continue readingThe land is one of the most important resources we have. It is what we rely on for food, shelter, and many other things.

Continue reading

A home warranty is a service agreement that covers the repair or replacement of major home system components and appliances.

Continue reading6 Tips When Starting Your Contracting Business. If you’re planning on starting a contracting business, you will find this guide useful.

Continue readingPrograms and services that encourage economic mobility and reduce barriers to workforce development not only connect New Yorkers.

Continue reading